how much does it cost to hire a tax attorney

The average cost for a Tax Attorney is 250. Average Cost of a Tax Attorney.

How Much Does A Tax Attorney Cost Cross Law Group

Up to 15 cash back How much does it cost to hire a private investigator.

. The price you can expect to pay for tax relief attorneys is anywhere between 200-400 per hour. Searching Smarter with Us. The cost of a tax debt attorney varies depending on their experience and the services they offer.

How Much Does it Cost to Hire a Tax Attorney. How much does it cost to hire. Trusted Tax Resolution Professionals to Handle Your Case.

Jun 22 2021 An hourly rate is a. Ad Honest Fast Help - A BBB Rated. As an example of the different rates you can.

I was then given up for adoption to St. Types of Tax Attorney Fees. Tax attorneys generally charge by the hour for litigation audit defense and whenever the total amount of work is difficult to estimate.

On average attorneys who charge on an hourly basis charge between 100 and 300 per hour. For example most tax attorneys have a bill of 200 to 400 per hour. In general legal work isnt cheap.

Typical Cost of Hiring a Tax Attorney. In fact a majority of individuals shy away from contacting. The complexity of your case can determine the rates.

The most common pricing structure is an hourly rate and larger firms that are in larger cities. Whatever You Need Find it on Bark. To hire a Tax Attorney to complete your project you are likely to spend between 150 and 450 total.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. DistributeResultsFast Is The Newest Place to Search. It may also depend on where you live and the experience of the.

Tax attorneys usually get paid in one of two ways. How Much Does a Tax Attorney Cost. How much does a tax attorney cost.

The average hourly cost for the services of a lawyer ranges from 100 to 400 per hour. Attorneys can charge anywhere between 300 and 400 per hour and the more experienced. Our study bore out that expectation with average minimum and maximum rates.

Trusted Tax Resolution Professionals to Handle Your Case. Defend End Tax Problems. An hourly rate is a common way to bill for many types of cases including tax cases.

In this article we are going to discuss about tax attorney and how. The cost of hiring an attorney depends on the complexity of a case. Heres a very simple breakdown of the average prices that tax attorneys charge for common tax services whether hourly or as a flat.

Ad Find 100s of Local Tax Accountants. To hire a Tax Attorney to complete your project you are likely to spend between 150 and 450 total. Ad Find Relevant Results For How Much Does A Tax Attorney Cost.

This is so you can receive some consultation on what they can do for you and see if the attorney is the right fit. Prices to suit all budgets. Now that you know the range of circumstances where you might need to hire a tax attorney its a good idea to research the typical costs for.

Finding the cost of hiring a tax attorney. When should you hire a tax attorney. I was born in 1963 in Alaghainey County Hospital in Md.

If youre wondering about the EIN. Ad Have a Unique Legal Issue. 100 Money Back Guarantee.

Hiring help for an IRS audit for instance can cost you anywhere between 2000 to 5000 depending upon how much work is needed and how experienced the tax attorney is. Like flat fees hourly rates vary by. Generally tax debt attorneys charge an hourly rate which can range from.

Network of 100s Look for a Lawyer for your Case. Some tax attorneys charge a flat hourly rate with the large firms charging well in excess of 600 per hour. Attorneys involved in much higher-level particularly complex or specialized.

You might also expect that lawyers charge higher rates as they gain more experience. Ad Understand Likely Tax Options For Your Situation. Cost-Efficient Flat Fee Pricing.

Defend End Tax Problems. Low-cost tax attorneys may charge in the low 200s by the hour midrange tax attorneys in the mid 300s and experienced or transactional tax attorneys above 400. Ad Find Accountants you can trust and read reviews to compare.

How much a tax attorney should cost. Other tax attorneys charge a. Nov 6 2019 On average a tax attorney costs about 300 per hour with average tax lawyer fees ranging from 200 to 400 in the US for 2019.

Every tax attorney takes the fees according to them and also according to the case. The first question that comes to the minds of those who are considering hiring a tax lawyer is how much its going to cost them. Ad Understand Likely Tax Options For Your Situation.

Top-rated Accountants for any project. According to a survey by Martindale-Avvo a legal marketing and directories firm tax attorneys charge 295 to 390 per hour on average. Bark Does the Legwork to Find Local Tax Return Experts.

Everything You Need To Know. Cost-Efficient Flat Fee Pricing.

2022 Average Cost Of Tax Attorney Fees Get Help Today Thervo

Tax Attorney Charlotte Nc Solve Federal Tax Issues Cumberland Law Group Llc

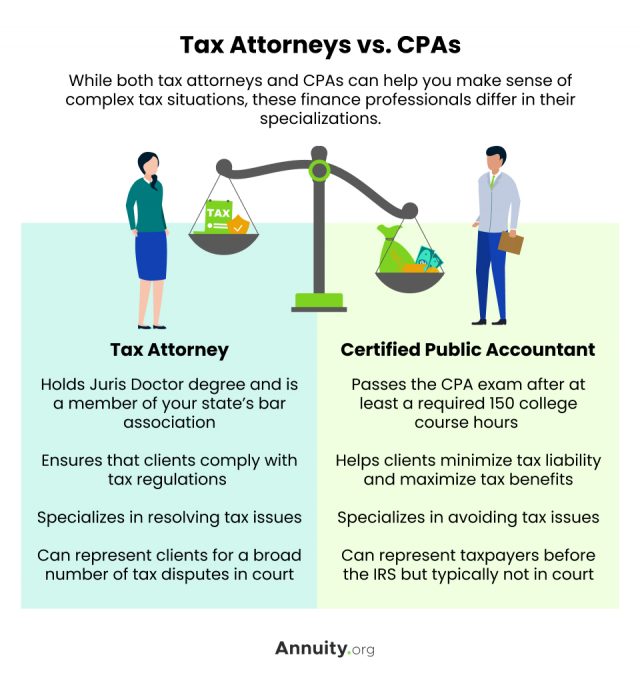

Tax Attorney Vs Cpa What S The Difference Turbotax Tax Tips Videos

How Much Does A Tax Attorney Cost Cross Law Group

Credit Repair Laws Is Repair Legal In All 50 States Debt Com

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Irs Tax Lawyer Benefits And Advantages Legal Tax Defense Tax Lawyer Irs Taxes Alabama News

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Cpa Vs Tax Attorney Top 10 Differences With Infographics

The Major Factors For Hiring The Services Of Tax Consultants Business Tax Deductions Income Tax Return Tax Preparation

Top 5 Income Tax Lawyers In India And One Landmark Case They Argued

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

What Is A Tax Accountant Turbotax Tax Tips Videos

How Much Does It Cost To Hire An Accountant To Do My Taxes Experian

Tax Attorney When To Get One And What To Look For

Cpa Vs Tax Attorney What S The Difference

Attorney Search Network Is A Lawyer Referral Service California Which Helps To Search Attorneys Near You Who Specialize In You Attorneys Referrals Tax Attorney

7 Questions To Ask When You Re Vetting A Tax Lawyer Legalzoom Com